Higlighted insights

Insights

-

Tax position of foreign owners of a Dutch business

-

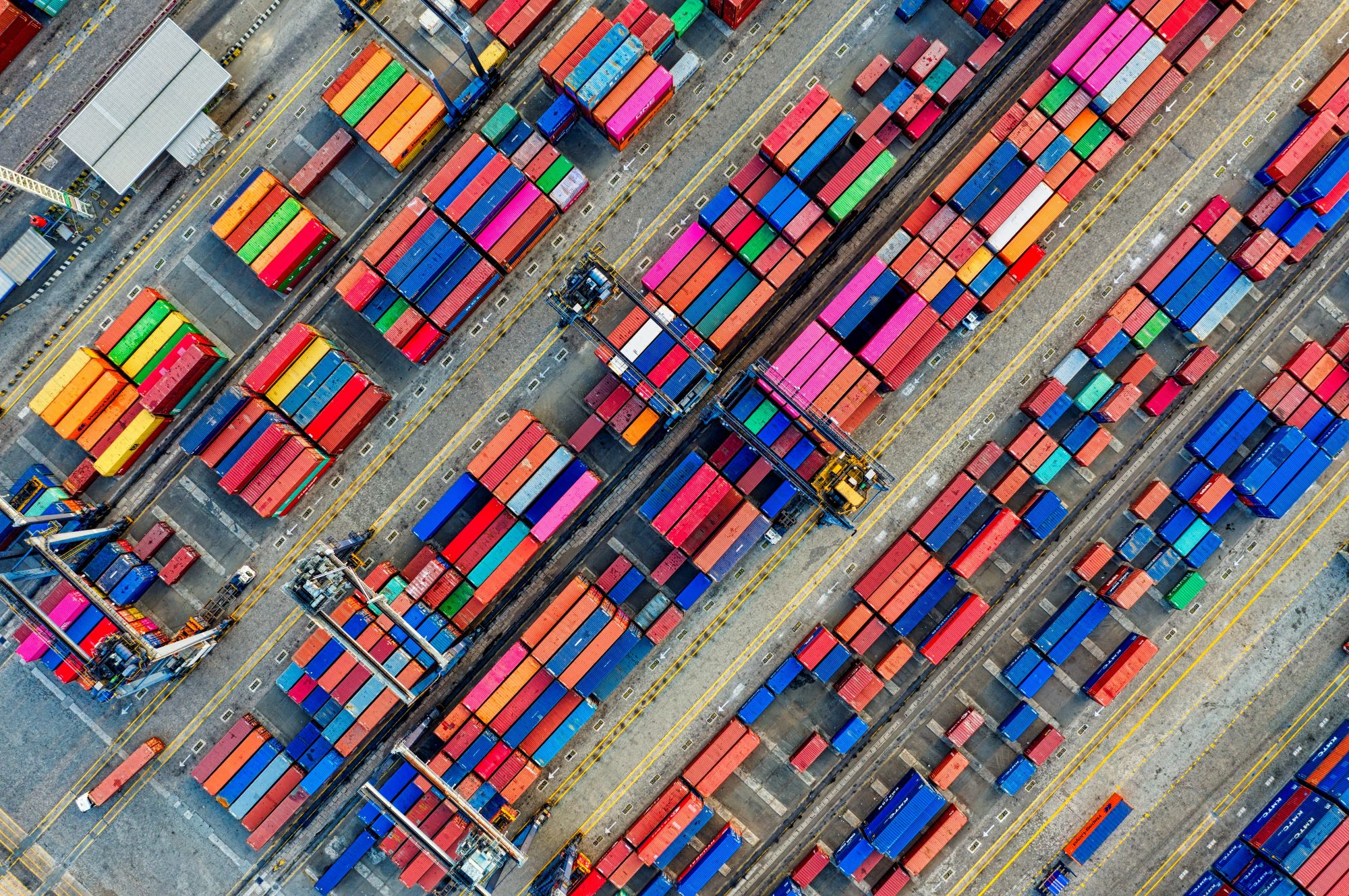

Importing goods into the Netherlands: what is relevant for your business?

-

Invoicing and your VAT position

-

Trading with the EU? The Netherlands as a gateway to Europe

-

New reporting obligation for multinationals: mandatory disclosure of tax on profits per state

-

Importing goods into the EU: a single transaction, multiple places of importation

-

Please note: new rules apply to pickup transactions from 1 April 2024

-

March 12, 2024

March 12, 2024Customs Talks: The importance of ‘Ownership’ for import VAT recovery

-

Note: reporting deadline EU Carbon Border Adjustment Mechanism (CBAM) 31 January 2024