Almost all Dutch corporate entities are obligated to prepare financial statements. This can take the form of preparing financial statements or a mandatory audit, depending on circumstances such as the size of the entity, revenue and assets and the position of the entity within a larger group. If you want to do business in the Netherlands, it is crucial that you are aware of your obligations.

In this article our experts discuss the main rules and exemptions regarding audit and accountancy such as:

Financial statements or audited accounts?

Accounting principles: Dutch GAAP of IFRS

Consolidation requirements and exemptions in the Netherlands

Preparation and filing deadlines

Voluntary audit

Review of the financial statements

Audit readiness measures

Financial statements or audited accounts?

The annual statements provide insight into the financial position of a company and may function as the basis for preparing the corporate income tax return (although fiscal adjustments may be required for the latter).

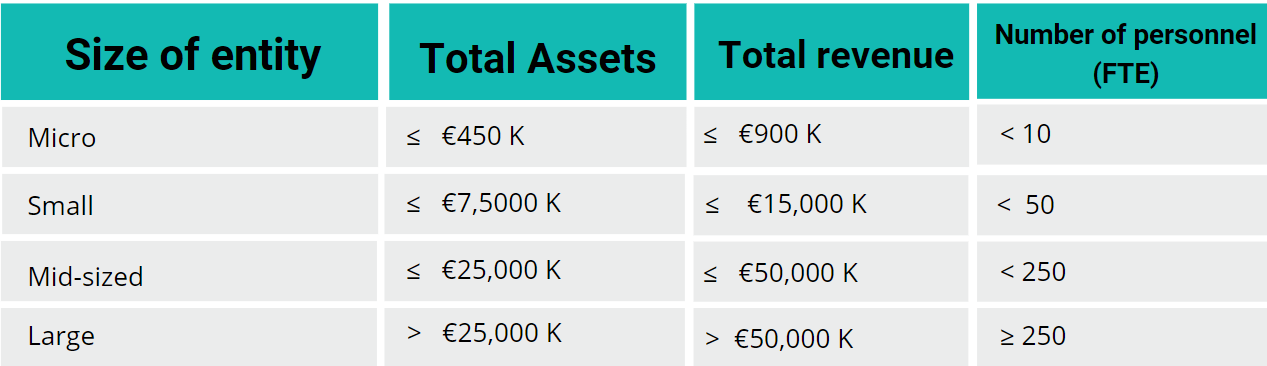

The size-category is determined based on the following table (applicable as from the 2024 financial year onwards). If 2 out of the following 3 criteria (assets, revenue, number of personnel) are met for 2 consecutive years (or the first year for newly formed companies), that category applies.

The company’s size determines whether a mandatory audit is required. Mid-sized and large companies are legally required to have their financial statements audited by a certified public auditor. Micro- and Small-sized entities are not; un-audited financial statements suffice for these smaller companies.

Accounting principles: Dutch GAAP or IFRS

Under Dutch Generally Accepted Accounting Principles (GAAP), companies in the Netherlands have several options for preparing their financial statements, both for company-only financials and consolidated financial statements. Depending on the nature and size of the company, the financial statements may be prepared based on one of the following principles:

Reporting based on tax principles (only for micro and small-sized entities)

Reporting based on Title 9 of the Dutch Civil Code (Dutch GAAP)

IFRS-EU

Dutch GAAP with IFRS-EU applicable to specific topics

Advantages of using Dutch GAAP are the simplified reporting requirements, more flexibility compared to IFRS and its suitability for small and medium-sized companies. A possible benefit of applying IFRS is that this system is widely accepted globally. IFRS enhances comparability and transparency and is therefore a suitable option for (mid-sized and large) multinational companies with subsidiaries in multiple countries. IFRS-EU is mandatory for the consolidated financial statements of listed companies.

Please note that Dutch rules require auditors to adhere to a Code of Ethics (Verordening inzake de onafhankelijkheid van Accountants bij assurance-opdrachten or ‘ViO’) to maintain their independence and objectivity while performing assurance services. The importance of ViO lies in its role in upholding the credibility and reliability of financial reporting.

The choice of reporting framework depends on various factors including the company's size, industry, regulatory requirements, and stakeholder preferences. Your accountant would be happy to explain in more detail which options are available for your company.

Consolidation requirements and exemptions in the Netherlands

In many cases, the legal entity that heads a group is required to prepare consolidated financial statements. Determining the group is an important requirement when preparing consolidated financial statements. Under Dutch law, the term “group” is defined as “an economic unit in which legal entities and companies are organisationally affiliated”.

A number of consolidation exemptions may apply under Dutch law, primarily based on the Dutch Civil Code (DCC). These consolidation exemptions aim to reduce the administrative burden for certain types of companies while still ensuring adequate transparency and accountability in financial reporting. Our experts would be happy to discuss the applicability of consolidation exemptions with you.

Preparation and filing deadlines

The financial statements must be prepared within five months after the end of the financial year. The financial statements must be filed with the Dutch Chamber of Commerce within eight days of their adoption by the general meeting of shareholders, and no later than two months after the date of preparation.

Under certain circumstances, this period may be extended by another five months (subject to approval by the general meeting of shareholders). If this extension is applied, filing should take place ultimately 12 months after the end of the financial year (or earlier, depending on the moment of preparation and the date of adoption).

Voluntary audit

Companies that are not subject to mandatory audit requirements may choose to have a voluntary audit performed. In some cases, parent companies or other stakeholders may request subsidiaries to perform a voluntary audit. Overall, a voluntary audit can provide numerous benefits for companies in the Netherlands, such as helping to enhance credibility, access to finance, risk management, compliance, and strategic decision-making.

Review of the financial statements

If you would like greater assurance about the reliability of your figures but your company is not required by law to have an audit performed, then a financial statements review may be the answer. Our auditors can review whether the financial statements are a true reflection of the organisation’s financial situation. A review engagement is perfect for companies that require a certain, limited degree of assurance, but are not obliged by law to undergo a statutory audit and do not wish to perform a (full) voluntary audit.

Audit readiness measures

As the audit of the financial statements takes place after the financial year has ended, it is important that all the required information and documentation is made available within a relatively short time period. In order to assure a smooth audit process and prevent potential delays, an audit readiness review may prove a useful tool. By meticulously preparing financial records and verifying transactions beforehand, businesses can avoid legal consequences and financial penalties associated with tardy submission of financial statements.

Proactive preparation not only enhances compliance with regulatory requirements but also fosters trust among stakeholders. Ultimately, investing in audit readiness measures is paramount for businesses aiming to uphold transparency, accountability, and operational efficiency during audits.

An audit readiness review is often particularly useful for companies facing their first mandatory audit. It is also often utilised by companies on the verge of growing from non-audit to audit sized.

Our services: how we can help your company

Preparing the financial statements, especially in cases of consolidation, requires in-depth knowledge of financial reporting and consolidation principles and can be complex depending on the group structure. Our specialists are ready to help. Where needed, Baker Tilly has the in-house expertise to support your business in fields such as Employment Advisory, Tax Services, Corporate Finance and Legal Advisory.

Our SME Accountancy & Advice experts can support you in preparing of your financial statements. Whether you require help and advice or wish to outsource the preparation of the financial statements altogether.

Our Audit Services specialists are committed to providing exceptional audit solutions tailored to the needs of clients facing a mandatory or voluntary audit. With our experienced teams, dedication to excellence, and focus on efficiency, we aim to deliver reliable, compliant, and value-driven audit services that help our clients achieve their business goals.

Questions?

A good auditor or accountant is crucial to your success in the Netherlands. If you have any questions about your obligations or our services, please do not hesitate to contact us.

The legislation and regulations in this area may be subject to change. We recommend that you discuss the potential impact of this with your Baker Tilly advisor.

Other insights

No results found