If your organisation is part of an international structure, it is subject to the Anti-Tax Avoidance Directive 2 (ATAD2). This is especially applicable in cases where there are differences in qualification with regard to the tax treatment of entities in the structure, or of financial instruments. These mismatches arise from differences in States’ tax laws. In this article, we will discuss a legislative proposal which aims to solve these mismatches as of 1 January 2022.

If your organisation is part of an international structure, it is subject to the Anti-Tax Avoidance Directive 2 (ATAD2). This is especially applicable in cases where there are differences in qualification with regard to the tax treatment of entities in the structure, or of financial instruments. These mismatches arise from differences in States’ tax laws. In this article, we will discuss a legislative proposal which aims to solve these mismatches as of 1 January 2022.

On Budget Day 2021, a legislative proposal was presented. This measure concerning tax liability is the final part of the implementation of the Anti-Tax Avoidance Directive. Based on the legislative proposal, a reverse hybrid entity will be subject to corporate income taxation as of 1 January 2022.

Read our previous articles about ATAD2, on differences in the qualification of legal entities/partnerships, financial instruments, and permanent establishments.

What is a reverse hybrid entity?

A reverse hybrid entity is a partnership that is entered into in accordance with Dutch law (such as a limited partnership or CV), or that is established in the Netherlands. At least 50% of the voting rights, capital interests, or rights to a share of profit of this partnership are held by an associated entity that is established abroad (the participant).

When is a reverse hybrid entity subject to corporate income taxation in the Netherlands?

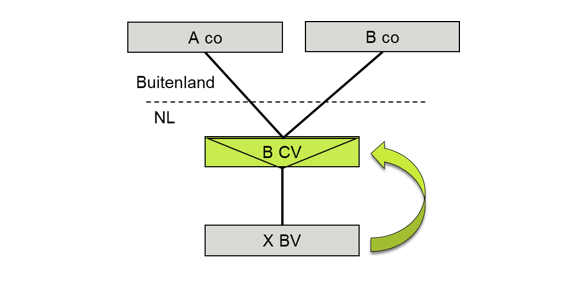

This is the case if the partnership is treated as transparent for Dutch tax purposes (and therefore not treated as an autonomous taxpayer), while the State in which the participant is located considers the partnership to be non-transparent (autonomous taxpayer). The figure below illustrates a structure with a reverse hybrid entity (B CV is the reverse hybrid entity)

Current situation

One of the consequences of the hybrid structure illustrated above is that the payment by X BV to B CV (prior to 1 January 2022) is not taxed at the level of B CV because the Netherlands assumes that the profit is taxed abroad, at the level of the participants (A co and B co). However, the payment by X BV to B CV is not taxed at the level of the participants, as the other State assumes B BV is subject to taxation in the Netherlands. In short, there is a deduction of the payment at the level of X BV, but without corresponding taxation of the payment at the level of the participants. This issue was repaired in 2020, through the implementation of anti-hybrid legislation that results in a denial of the deduction at the level of X BV.

The situation as of 1 January 2022

Corporate income tax liability

As of 1 January 2022, double non-taxation will be addressed by removing the difference in qualification, by including B CV in taxation. As of 1 January 2022, the legislative proposal therefore removes the mismatch itself, and reverse hybrid entities are subject to corporate income taxation in the Netherlands. As a result, the profits of B BV are taxed in the Netherlands, which means that there is no reason to deny the deduction of the payment at the level of X BV.

Possible withholding obligations

In addition to the liability for corporate income taxation, the legislative proposal also has a number of other consequences. As of 1 January 2022, the reverse hybrid entity may also have a withholding obligation with regard to dividend taxes and the source tax for interest and royalties. Regarding personal income taxation, it is noted that the definition of substantial interest will be extended, so that an interest in a reverse hybrid can also qualify as a substantial interest as of 1 January 2022.

ATAD2: we can help you address the issue

ATAD2 involves complicated legislation and may lead to, for example, non-deductible costs or even a tax liability for partnerships in the Netherlands. It is important to recognise and analyse the (reverse) hybrid entities and hybrid mismatches in your corporate structure. At Baker Tilly, we have the necessary expertise to perform this analysis. Our ATAD2 specialists work closely with colleagues within the Baker Tilly International network, providing comprehensive advice on the effective implementation of these measures from a Dutch as well as an international perspective.

The measures described above are legislative proposals. The proposals have yet to be approved by the House of Representatives and the Senate. Please note: the proposals may still be subject to changes.

Feel free to contact us

Would you like to know what effect ATAD2 will have on your organisation? Or can we be of assistance in any other areas of international tax law? Please do not hesitate to contact us.

This content was published more than six months ago. Because legislation and regulation is constantly evolving, we recommend that you contact your Baker Tilly consultant to find out whether this information is still current and has consequences (or offers opportunities) for your situation. Your consultant will be happy to discuss the latest state of affairs with you.

Other insights

-

Minimum taxation Pillar 2: exclusions, safe harbours, and pitfalls

-

Pillar Two: How to prepare for the new minimum taxation

-

Pillar Two: Introducing a minimum level of taxation for multinational enterprises and large companies in 2024