Your organisation is part of an international structure. The Anti-Tax Avoidance Directive 2 (ATAD2) may affect your organisation. Whether this is the case, depends amongst other things on whether your structure includes a hybrid mismatch. But what exactly is a hybrid mismatch?

Hybrid mismatches concern differences in qualification stemming from differences in States’ tax laws. Examples are differences in the qualification for tax purposes of legal entities and partnerships (hereinafter: entities), financial instruments and permanent establishments. We will elaborate on hybrid mismatches involving entities, below.

Differences in the qualification with regard to entities

An entity, such as a Dutch limited company (BV), cooperation, limited partnership (CV) or general partnership (vof), is qualified either as an independent taxpayer, or as a transparent entity. In the case of an independent taxpayer, the entity must file its own corporate income tax return and is liable for any taxes due. A Dutch example is the limited company (BV).

A transparent entity does not file its own corporate income tax return; the participants of the transparent entity each report their share of the entity’s profits in their own tax return. For an individual participant this would be reported in the personal income tax return. If the participant is an entity which is independently subject to taxation, it would concern their corporate income tax return. An example of a transparent entity is a general partnership (vof).

A hybrid entity is an entity that is qualified in two different ways by (two) different States. One State sees the entity as an independent taxpayer, whereas the other State regards the entity as transparent. This can lead to a discrepancy in terms of where the States expect that the entity would be taxed. From the perspective of the first State, taxation should occur in the State of residence of the entity itself. By contrast, from the perspective of the second State, taxation would occur in the State(s) of the participants of the entity.

Benefitting from differences in qualification

Prior to ATAD2, it was possible to benefit from these hybrid mismatches. Deduction without inclusion in taxation and/or double deduction of expenses, led to significant benefits. A number of examples are discussed below.

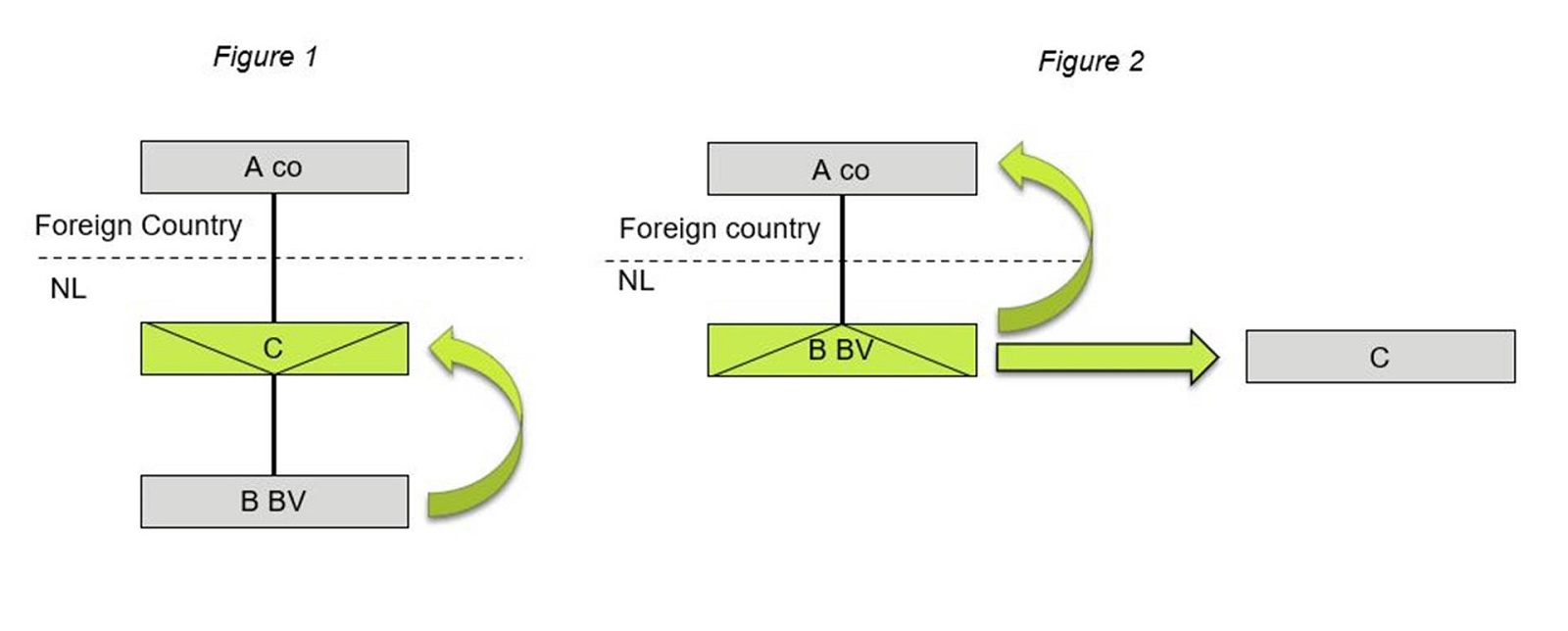

In Figure 1, a payment from B BV to C takes place. C is a hybrid entity. The Netherlands regards C as transparent. The profit, including the revenue which C receives from B BV, should therefore be taxed at the level of A co in the Foreign State. However, the State in which A co is established, considers C to be an entity which is an independent taxpayer. C should be liable to taxation on its profits in the Netherlands, according to the State in which A co is established. Overall, no taxes are due on the revenue which C receives from B BV, while the expense is deductible. This means that deduction without inclusion takes place.

In Figure 2, B BV performs a payment to A co and to a third party (C). The State in which A co is established considers B BV to be a transparent entity, while the Netherlands considers B BV to be an independent taxpayer. The payment to A co is deducted at the level of B BV. As B BV is transparent (from the perspective of A co), the expense of the payment by B BV to A co is also taken into account at the level of A co. The revenue of A co which stems from the payment from B BV is offset against the expense. Therefore there is deduction at the level of B BV, but no inclusion at the level of A co.

The payment by B BV to C is also deducted at the level of A co, due to the transparent nature (from the perspective of A co) of B BV. Therefore there is a deduction at the level of B BV as well as A co. This means double deduction takes place.

ATAD2, what now?

As of 1 January 2020, ATAD2 is in force. ATAD2 addresses hybrid mismatches. This may, amongst other things, lead to a situation in which expenses, which were deductible prior to 1 January 2020, are no longer deductible. It is therefore important to analyse the hybrid mismatches in your structure. Recognising hybrid mismatches requires specialist expertise, as well as knowledge of foreign tax law.

Baker Tilly has the specialist expertise needed to perform this analysis. A number of our advisors are intensively engaged in ATAD2 issues. An important additional benefit is that Baker Tilly is a part of the Baker Tilly International network. This enables us to quickly and efficiently involve foreign specialists in the ATAD2 analysis.

Every company that is part of an international structure is affected by ATAD2. You can learn more about this complex fiscal legislation, and our expertise in this area, on our special ATAD2 webpage. In addition to up-to-date knowledge of ATAD2, Baker Tilly has developed a web-based tool: the ATAD2 Risk Assessment. Would you like to gain a preliminary insight into the ATAD2 risks in your specific case? Please check out our ATAD2 Risk Assessment.

Contact

Do you have any questions regarding your business and the consequences of ATAD2? Would you like to perform an impact analysis regarding ATAD2 for your organisation? Or do you have any other questions concerning international tax law? Please do not hesitate to contact us.

This content was published more than six months ago. Because legislation and regulation is constantly evolving, we recommend that you contact your Baker Tilly consultant to find out whether this information is still current and has consequences (or offers opportunities) for your situation. Your consultant will be happy to discuss the latest state of affairs with you.

Other insights

-

Minimum taxation Pillar 2: exclusions, safe harbours, and pitfalls

-

Pillar Two: How to prepare for the new minimum taxation

-

Pillar Two: Introducing a minimum level of taxation for multinational enterprises and large companies in 2024