If your organisation is part of an international structure, the Anti-Tax Avoidance Directive 2 (ATAD2) may affect your Dutch corporate income tax return. The term ‘hybrid mismatch’ is central to ATAD2. But how do you know whether your structure contains a hybrid mismatch?

A hybrid mismatch may occur in cases where there are differences in qualification stemming from differences in States’ tax laws. It is possible that the costs of transactions are (intentionally or coincidentally) deductible in one country, whereas the income is not taxed in any other country. Such constructions are deemed undesirable and are addressed by the EU with ATAD2.

Hybrid mismatches may stem from differences in the qualification for tax purposes of legal entities and partnerships (hereinafter: entities), financial instruments and permanent establishments. In the below, we will elaborate on hybrid mismatches involving permanent establishments.

What is a permanent establishment?

Imagine, a Dutch company wishes to develop (new) business activities in another country, without establishing a legal entity in that other country. This can be done by using a fixed place of business in said country. The profits stemming from these activities will in that case most likely be subject to taxation by the tax authorities in that country. From a tax perspective, a so-called permanent establishment is created, to which profits and costs are allocated. In this way, the profit is subject to taxation in the country in which the permanent establishment is located.

This explanation is greatly simplified. Whether a permanent establishment is present depends on the specific situation and the local tax regulations. If you perform activities in a specific country, we advise you to perform a risk assessment for the presence of a permanent establishment. This can be done by using our ‘PE-tracker’. This risk assessment is based on a list of questions, and can be found in the Baker Tilly Taxmapp. This app can be downloaded for iOS and Android.

Differences in qualification with regard to permanent establishments

It is not always clear whether a permanent establishment is present. This uncertainty is caused in part by the fact that tax regulations differ between countries. It is therefore possible that one country recognises a permanent establishment, and the other country does not. In such cases, we speak of a ‘disregarded permanent establishment’. Even if both countries do recognise a permanent establishment in a particular situation, they may apply a different set of rules for the allocation of profits and costs to the permanent establishment. These kinds of cases are called hybrid mismatches with regard to permanent establishments.

Use of differences in qualification

Prior to the introduction of ATAD2, the absence of taxation on profits, and/or double deduction of costs led to a situation which was potentially beneficial for the organisations involved, but altogether undesirable from the perspective of the tax authorities. We will illustrate this with a number of examples.

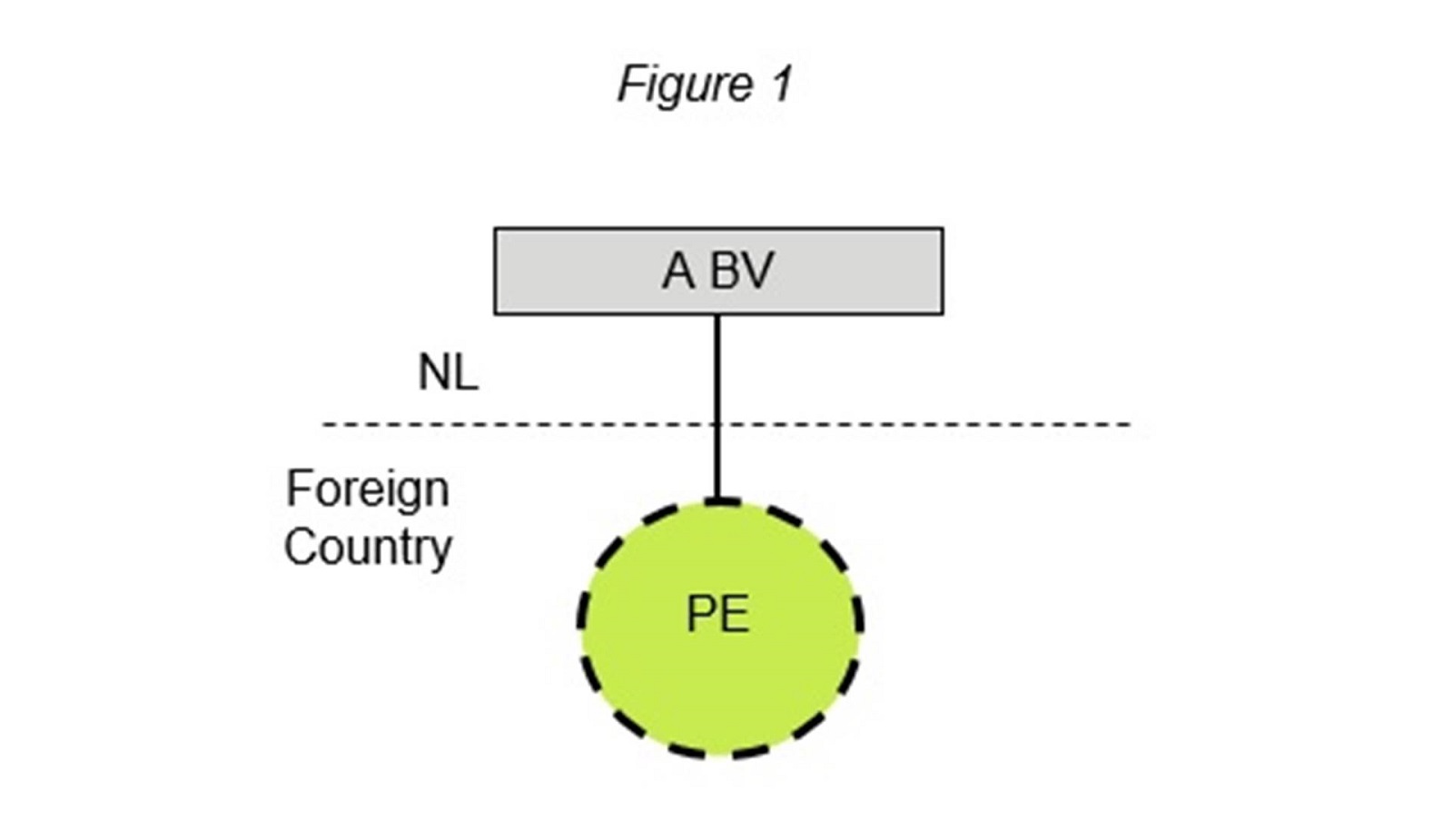

In Figure 1, there is a permanent establishment from a Dutch tax perspective. The Netherlands assumes that the profit of the permanent establishment is taxed in the Foreign Country. This profit is exempt from taxation in the Netherlands under the so-called ‘object exemption’. However, based on the tax rules in the Foreign Country, no permanent establishment is recognised in that country. This leads to a situation in which the profit is not subject to taxation to either country. ATAD2 tackles this mismatch by preventing that the income is exempt in the Netherlands. The profit of the permanent establishment is then taxed in the Netherlands.

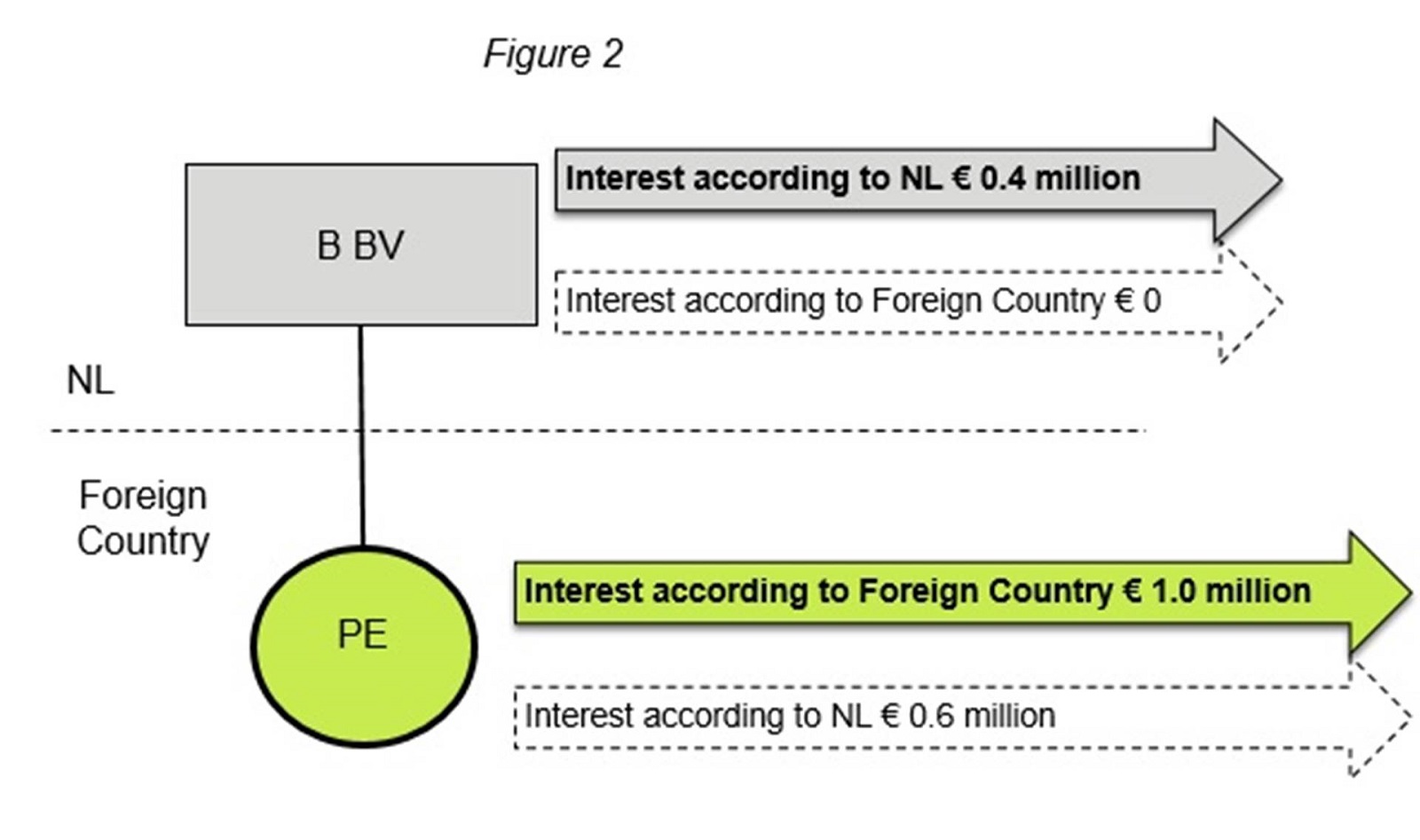

In Figure 2, B BV has obtained a loan from a bank in order to finance the activities in the permanent establishment. The interest due on this loan is € 1 million. Both the Netherlands and the Foreign Country recognise a permanent establishment in accordance with their own tax laws. However, the two countries allocate the interest expenses differently, based on differences in local tax legislation. For example, the Netherlands may apply the ‘Authorised OECD Approach’ (Organisation for Economic Cooperation and Development), allocating part of the interest (i.e. € 0.6 million) to the permanent establishment, and the remaining € 0.4 million to B BV. By contrast, based on local tax law and in accordance with the applicable tax treaty, the Foreign Country in which the permanent establishment is located, can allocate the full amount of the interest to the permanent establishment. A possible consequence is that a part of the interest is deductible both in the Foreign Country and in the Netherlands (i.e. € 0.4 million). This means that there is a double deduction. ATAD2 tackles this problem as follows: the interest expense allocated to B BV based on Dutch tax law, is no longer deductible in the Netherlands.

ATAD2: What now?

The tax measures of ATAD2 entered into force on 1 January 2020. ATAD2 addresses undesirable tax consequences of hybrid mismatches. This may, amongst other things, (potentially) lead to a situation in which expenses, which were deductible prior to 1 January 2020, are no longer deductible, or a situation in which the object exemption can no longer be applied. It is therefore important to analyse the hybrid mismatches in your structure. Understanding hybrid mismatches in specific situations requires knowledge about foreign tax law. In this regard, the Baker Tilly International network can be very beneficial for you. Our tax specialists work closely with the tax specialists from the Baker Tilly International network in other countries, to share knowledge about how ATAD2 works and what its impact is, in order to assist internationally operating organisations. You can learn more about this complex fiscal legislation, and our expertise, on our special ATAD2 webpage. In addition to up-to-date knowledge of ATAD2, Baker Tilly has developed a web-based tool: the ATAD2 Risk Assessment. Would you like to gain a preliminary insight into the ATAD2 risks in your specific case? Please check out our ATAD2 Risk Assessment.

Contact

Do you have any questions regarding your business and the consequences of ATAD2? Would you like to perform an impact analysis regarding ATAD2 for your organisation? Or do you have any other questions concerning international tax law? Please do not hesitate to contact us.

This content was published more than six months ago. Because legislation and regulation is constantly evolving, we recommend that you contact your Baker Tilly consultant to find out whether this information is still current and has consequences (or offers opportunities) for your situation. Your consultant will be happy to discuss the latest state of affairs with you.