The Dutch government has recently held a public consultation on a legislative proposal in the area of transfer pricing (‘TP’). The proposal was already announced on Budget Day 2020 and aims to combat mismatches due to TP adjustments as a result of the application of the arm’s length principle. The intended date of entry into force is 1 January 2022.

Transfer pricing mismatches

For Dutch tax purposes, affiliated entities that do business with each other, must do so under third party conditions. This TP principle is referred to as the ‘arm’s length principle’. In the case of cross-border intra-group transactions, situations can arise whereby the Netherlands applies the arm’s length principle, whereas the country in which the affiliated party is based, does not (or not in the same way as the Netherlands does). This can result in TP mismatches.

The proposed legislation aims to prevent non-taxation as a result of such TP mismatches. In particular, the proposal would deny a downward TP adjustment in the Netherlands, if this is not (or not fully) matched by a corresponding upward correction to the tax base of the affiliated (foreign) entity. In such cases, the downward correction in the Netherlands is denied. Such TP corrections can occur in relation to various different kinds of intra-group transactions.

Intra-group remunerations

Currently, if a Dutch entity pays no or too little remuneration to an affiliated entity, for goods and services that have been provided, the Dutch entity may take an arm’s length remuneration into account when determining its tax base in the Netherlands. This means that the Dutch entity can take an additional deduction into account for Dutch tax purposes, to the amount of the difference between the agreed-upon remuneration and an arm’s length remuneration. This results in a downward adjustment of the tax base in the Netherlands.

If the legislative proposal passes, the Dutch Tax Authorities (‘DTA’) would deny such a downward adjustment of the tax base in the Netherlands, insofar as the affiliated entity does not apply a corresponding upward adjustment.

Intra-group loans

The legislative proposal may also apply to intra-group loans. In the case of an interest-free intra-group loan, or an intra-group loan whereby the contractually agreed upon interest rate is lower than an arm’s length interest rate, the DTA will deny the deduction of an (imputed) arm’s length interest expense, if the corresponding remuneration is not included in the tax base of the affiliated entity.

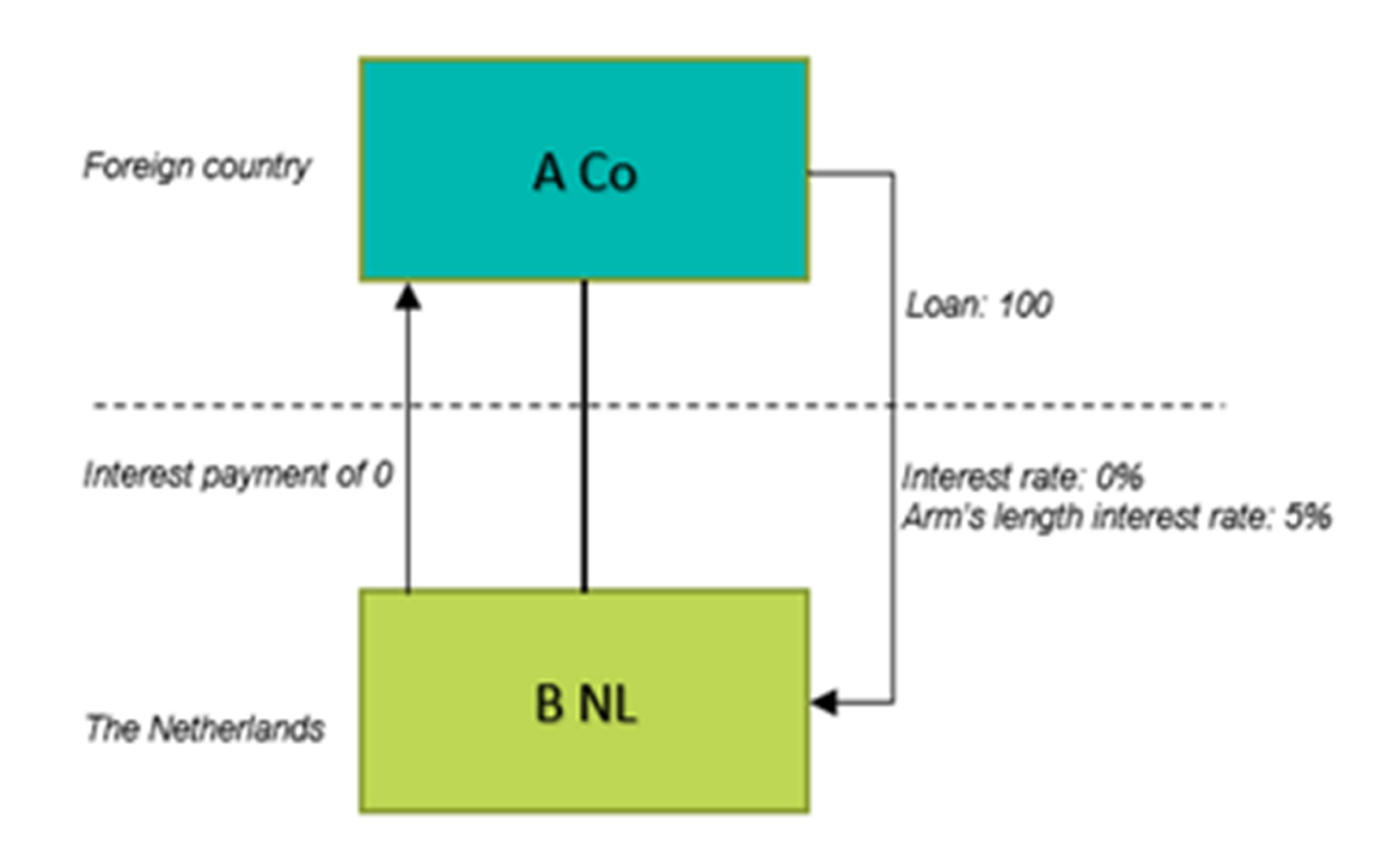

Example

A Co is a parent company established abroad, which provides an interest-free loan of 100 to its Dutch subsidiary B NL. The agreed-upon interest rate is 0%, whereas an arm’s length interest rate would be 5%. No interest is included in the tax base of A Co in the foreign country where it is established. However, under Dutch tax law, B NL must take into account an arm’s length interest charge. Therefore, B NL can deduct an interest charge of 5% from its tax base.

Based on the legislative proposal at hand, the interest charge of 5% (the arm’s length correction) will be denied by the DTA. The agreed-upon interest rate of 0% is taken into account for Dutch tax purposes. Consequently, no interest expense is deductible from B NL’s tax base in the Netherlands.

Transfer of assets

Furthermore, the proposal aims to deny an upward TP adjustment of the acquisition price of an asset, insofar as no corresponding upward TP correction is included in the tax base of the affiliated entity that transferred the asset. For an acquired asset, an arm’s length adjustment to the fair market value will be denied if the lower value of the asset is taken into account as the sales price at the level of the affiliated entity.

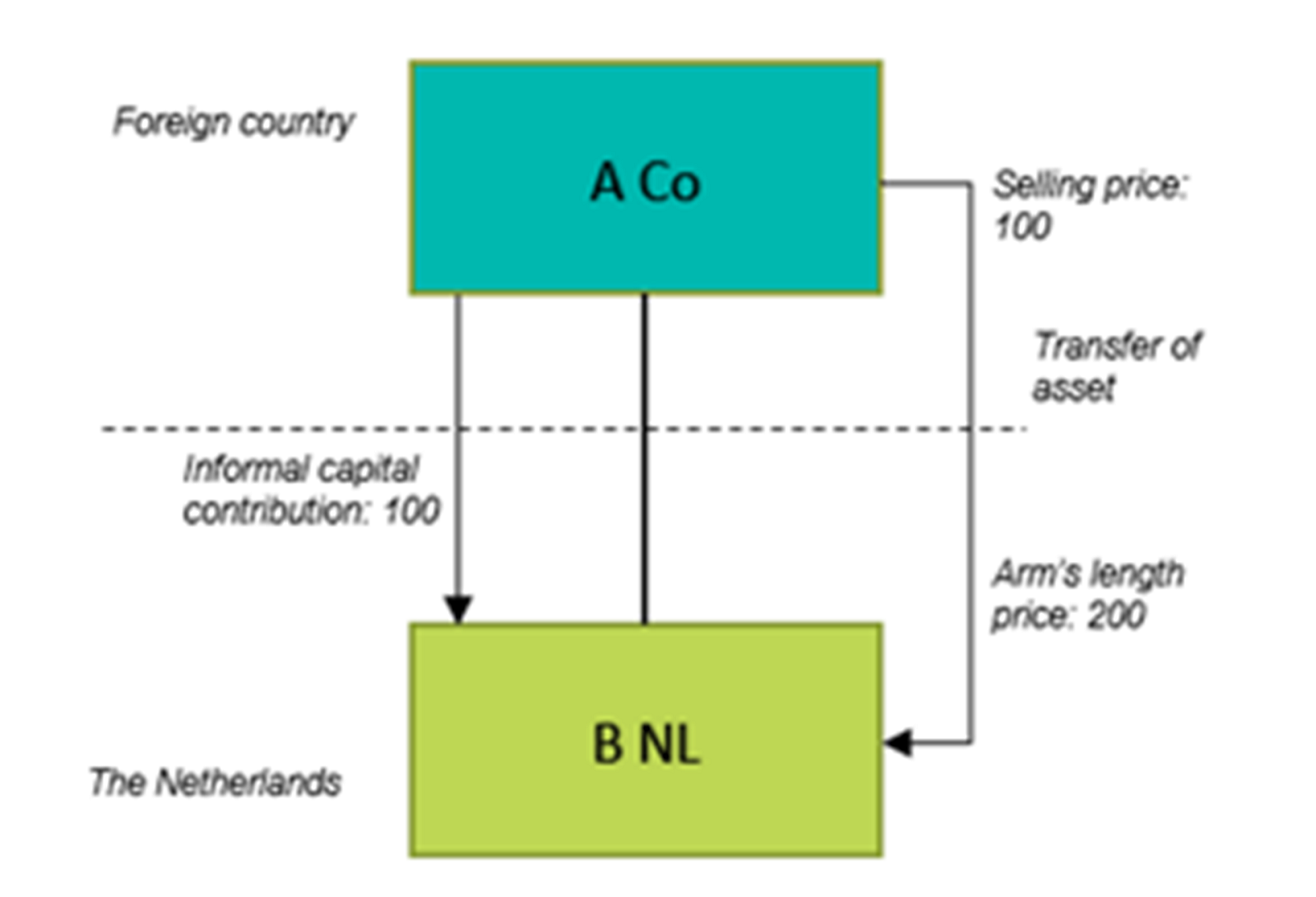

Example

A Co, located outside of the Netherlands, transfers an asset to its Dutch subsidiary B NL, for an agreed-upon price of 100. The arm’s length price of the asset amounts to 200. The depreciation period is five years and the residual value of the asset is nil. At the level of A Co, an amount of 100 is included in the tax base. B NL capitalises the asset on its tax balance, at an arm’s length amount of 200, resulting in an informal capital contribution in B NL by A Co of 100. The amount of 200 can be depreciated against B NL’s tax base over a period of five years, at a rate of 40 per year.

Based on the legislative proposal, B NL will have to capitalise the asset on its tax balance at the agreed-upon price of 100 instead of the arm’s length amount of 200. The annual depreciation will consequently amount to 20.

Restriction of depreciation

Finally, the proposal provides for an adjustment of the depreciation base of assets transferred in the five years preceding the proposal’s intended date of entry into force (1 January 2022). The depreciation base of such assets will be adjusted upwards, insofar as an upward TP adjustment of the transferred asset would have been denied under the proposed legislation (had the asset been transferred on or after 1 January 2022).

This restriction means that, for reporting periods commencing on or after 1 January 2022, depreciation will no longer be based on the (higher) arm’s length value, but rather on the (lower) agreed-upon value. Existing informal capital structures may therefore also be affected by the proposed legislation.

Burden of proof

The burden of proof for demonstrating that an affiliated foreign entity has included a corresponding correction in its foreign tax base, lies with the Dutch taxpayer.

The legislative proposal in a nutshell

In cases of intra-group transactions, the legislative proposal aims to deny, for Dutch tax purposes, a downward TP adjustment resulting from the application of the arm’s length principle, insofar as no corresponding upward TP correction is included in the tax base of the foreign affiliated entity involved with the intra-group transaction.

Existing informal capital structures may also be affected by the proposed legislation.

The burden of proof lies with the Dutch taxpayer.

If you have any questions about the legislative proposal, its consequences and options in your specific situation, please contact us.

This content was published more than six months ago. Because legislation and regulation is constantly evolving, we recommend that you contact your Baker Tilly consultant to find out whether this information is still current and has consequences (or offers opportunities) for your situation. Your consultant will be happy to discuss the latest state of affairs with you.